Introduction

India’s automotive sector, one of the largest and most dynamic in the world, is undergoing significant structural changes driven by technological advancements, evolving consumer preferences, regulatory shifts, and global market dynamics. The Indian automobile industry, valued at approximately $118 billion, contributes nearly 7.1% to the country’s GDP and employs over 37 million people. However, recent years have witnessed a complex mix of growth opportunities and strategic challenges, prompting major manufacturers to reassess their operations, partnerships, and market positioning.

This article explores the key factors driving these changes, including shifts in manufacturing strategies, the rise of electric vehicles (EVs), evolving supply chain models, and the impact of government policies. It also analyzes how leading automotive players are adapting to these changes to maintain competitiveness and future-proof their operations.

Overview of the Indian Automotive Market

India is the fourth-largest automobile market globally, with domestic production of over 30 million vehicles annually. The sector includes a diverse range of segments, from passenger cars and commercial vehicles to two-wheelers and electric vehicles.

Key Market Segments

- Passenger Vehicles (PV): India’s PV market is highly competitive, with Maruti Suzuki, Hyundai, and Tata Motors holding a significant market share.

- Commercial Vehicles (CV): The CV segment is heavily influenced by infrastructure development and logistics demand, with companies like Ashok Leyland and Tata Motors leading the sector.

- Two-Wheelers: India is the world’s largest two-wheeler market, with players like Hero MotoCorp, Bajaj Auto, and TVS Motors dominating the segment.

- Electric Vehicles (EV): The EV market is rapidly growing, supported by government incentives, rising fuel prices, and increasing environmental awareness.

Recent Performance

- Passenger vehicle sales grew by 9% in 2023, driven by strong demand for SUVs and hybrid models.

- Two-wheeler sales experienced a moderate 5% increase, supported by rising rural demand and the growing popularity of electric scooters.

- Commercial vehicle sales declined slightly due to weak infrastructure investments and higher borrowing costs.

- EV sales grew by over 50%, reflecting strong consumer interest and expanding charging infrastructure.

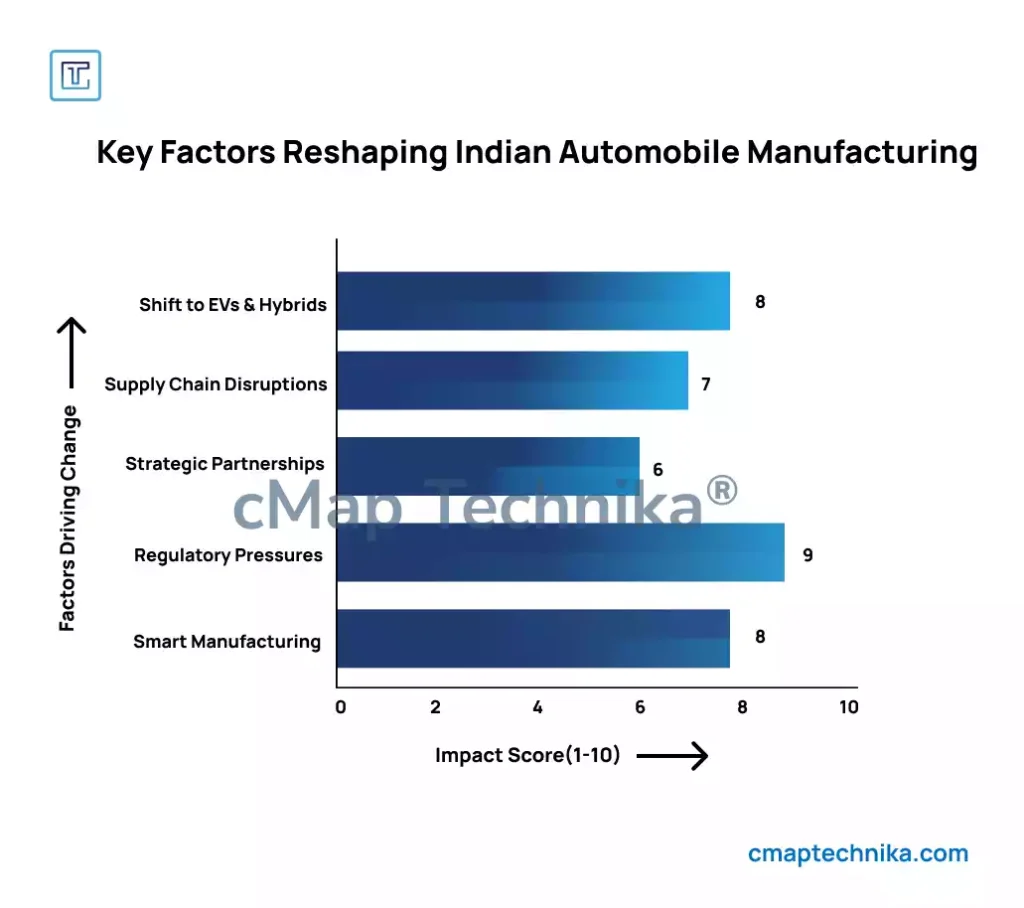

Key Factors Reshaping the Automobile Manufacturing Landscape

1. Shift Toward Electric and Hybrid Vehicles

The transition from internal combustion engine (ICE) vehicles to electric and hybrid vehicles is one of the most significant changes reshaping India’s automotive sector.

- Government Incentives: The Indian government’s Faster Adoption and Manufacturing of Electric Vehicles (FAME) scheme provides subsidies for electric vehicle purchases and infrastructure development.

- Manufacturing Adjustments: Leading manufacturers such as Tata Motors and Mahindra & Mahindra are investing heavily in EV production lines, battery plants, and research and development (R&D) facilities.

- Challenges: The shift to EVs presents challenges related to battery supply chains, infrastructure limitations, and higher initial production costs.

Example:

- Tata Motors has emerged as a market leader in the EV segment, holding over 60% of the domestic market share. Its Nexon EV model has become a benchmark for affordability and performance in the electric SUV category.

- Hyundai and MG Motors have also introduced competitive EV models, focusing on affordability and fast-charging capabilities to meet growing consumer demand.

2. Global Supply Chain Disruptions and Realignments

The automotive sector has been severely impacted by global supply chain disruptions triggered by the COVID-19 pandemic, geopolitical tensions, and semiconductor shortages.

- Semiconductor Shortage: The shortage of semiconductor chips has resulted in production slowdowns and increased vehicle delivery times.

- Localized Sourcing: To reduce reliance on global suppliers, manufacturers are increasing their focus on localized production and securing alternative supply routes.

- Logistics Challenges: Rising freight costs and shipping delays have increased operational costs, pushing manufacturers to explore nearshoring and multi-sourcing strategies.

Example:

- Maruti Suzuki, India’s largest car manufacturer, announced a $1.3 billion investment to establish a new semiconductor manufacturing unit in Gujarat, aiming to reduce dependence on imported chips.

- Hyundai and Kia have adopted a dual-sourcing model for key components to enhance supply chain resilience and minimize disruption risks.

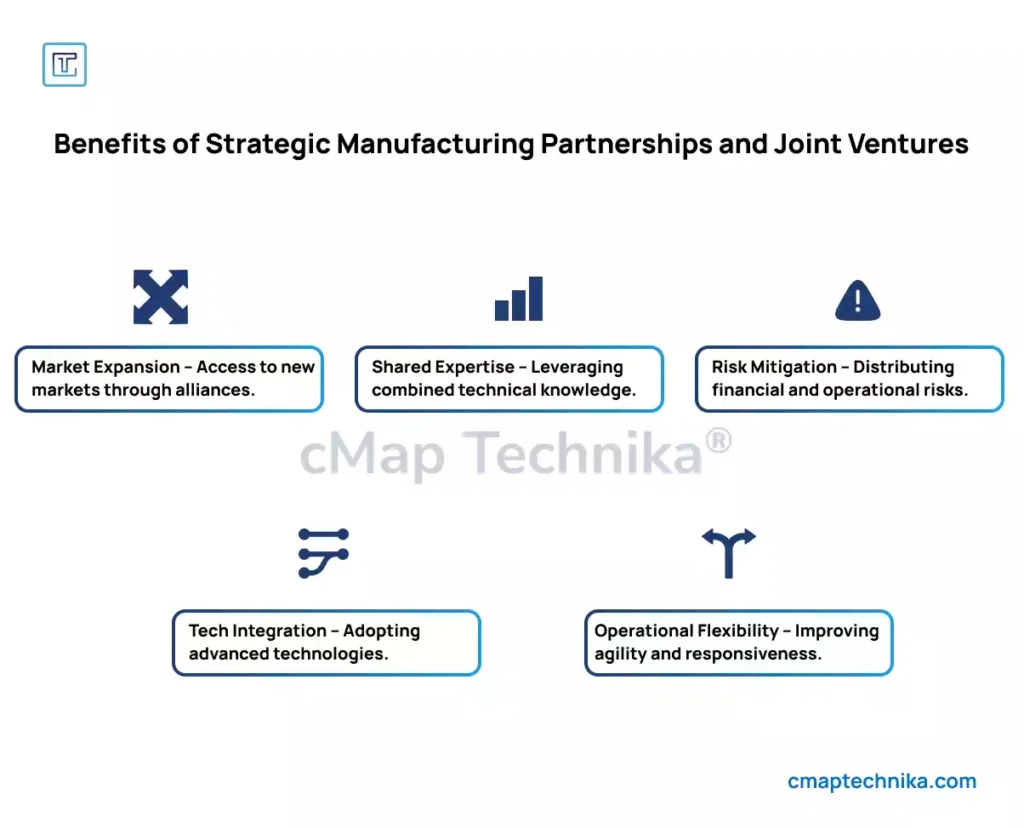

3. Strategic Manufacturing Partnerships and Joint Ventures

To navigate the complexities of market realignment, automotive companies are forming strategic alliances and joint ventures to share risks, reduce costs, and accelerate product innovation.

- Joint Ventures: Maruti Suzuki and Toyota have collaborated to develop hybrid models suited for Indian road conditions and consumer preferences.

- Tech Partnerships: Tata Motors partnered with TPG Rise Climate to raise $1 billion for EV development and infrastructure expansion.

- Global Expansions: Indian manufacturers are expanding into foreign markets, leveraging cost advantages and technological expertise.

Example:

- Ashok Leyland has entered into a joint venture with Hitachi to integrate advanced mobility solutions into its commercial vehicle lineup.

- Mahindra & Mahindra signed a technology-sharing agreement with Volkswagen to co-develop electric vehicle platforms.

4. Regulatory and Environmental Pressures

The Indian government has introduced stringent emission standards and fuel efficiency regulations to reduce environmental impact and promote cleaner transportation solutions.

- BS-VI Emission Standards: The transition to Bharat Stage VI (BS-VI) standards has forced manufacturers to upgrade engine designs and production processes.

- EV Incentives: The FAME II scheme and the production-linked incentive (PLI) scheme for advanced chemistry cells have encouraged EV adoption and battery manufacturing.

- Scrappage Policy: The vehicle scrappage policy introduced in 2021 encourages the replacement of old, polluting vehicles with newer, cleaner models.

Example:

- Hyundai and Kia have announced plans to make 70% of their global vehicle lineup electrified by 2030, aligning with evolving regulatory requirements and sustainability goals.

- Honda has shifted production to hybrid models and plans to introduce fully electric models by 2025 to meet India’s fuel efficiency targets.

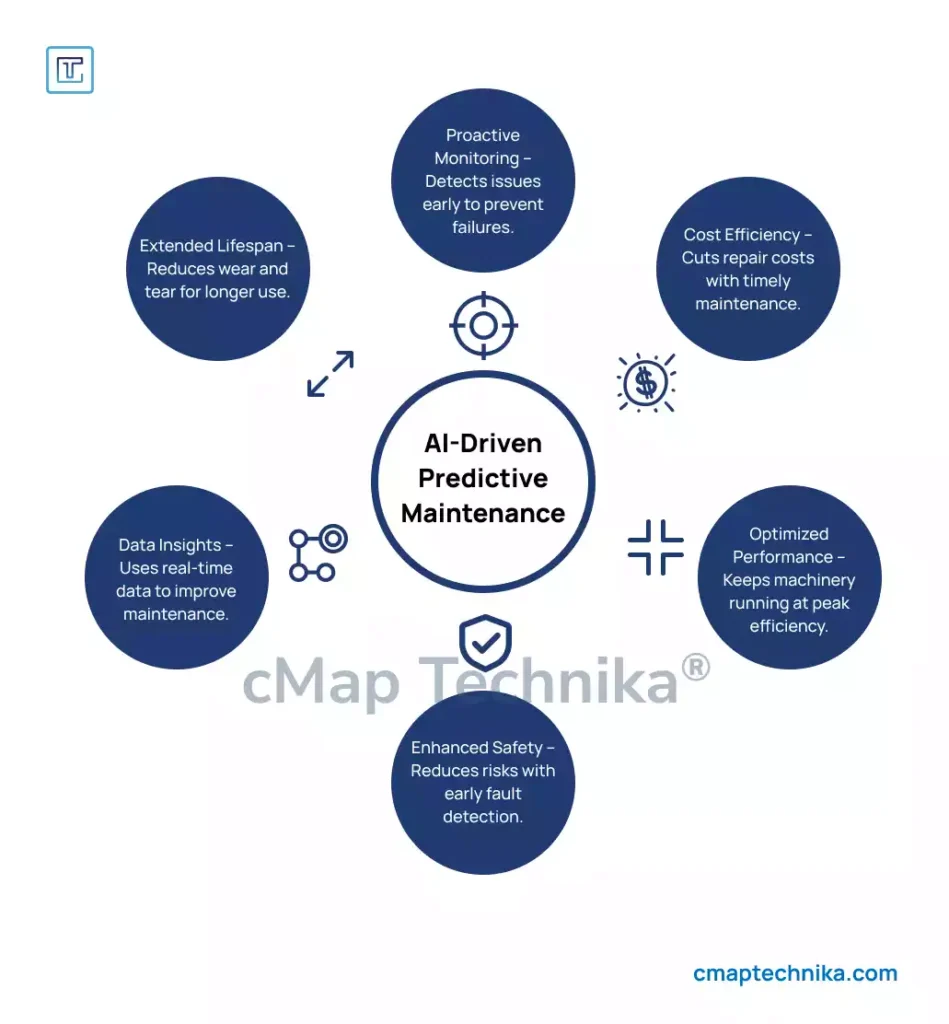

5. Rise of Smart Manufacturing and Automation

Automotive manufacturers are increasingly adopting smart manufacturing techniques such as Industry 4.0, AI, and robotics to enhance efficiency and reduce production costs.

- Automated Assembly Lines: Companies like Tata Motors and Maruti Suzuki have introduced automated manufacturing systems to improve consistency and output quality.

- AI-Driven Predictive Maintenance: AI algorithms are being used to monitor machinery health and predict potential failures, reducing downtime.

- Digital Twins: Manufacturers are deploying digital twin technology to simulate production processes and identify optimization opportunities.

Example:

- Ford India has implemented an AI-based quality control system that reduced defect rates by 30% and improved production throughput by 20%.

- Hero MotoCorp introduced an automated painting system that increased efficiency by 15% while reducing environmental impact.

Challenges and Future Outlook

Challenges

- High Initial Costs: Transitioning to electric and hybrid vehicles requires significant capital investments.

- Supply Chain Vulnerabilities: Ongoing semiconductor shortages and logistical disruptions could persist in the near term.

- Consumer Price Sensitivity: Affordability remains a key barrier to EV adoption, particularly in rural markets.

Future Outlook

Despite these challenges, the Indian automotive sector is poised for sustained growth over the next decade. The convergence of electric mobility, smart manufacturing, and regulatory reforms is expected to reshape the competitive landscape.

- EV Penetration: EVs are projected to account for over 30% of total passenger vehicle sales by 2030.

- Manufacturing Innovation: Smart factories and automation will increase production efficiency and enhance product quality.

- Global Expansion: Indian automotive manufacturers are well-positioned to increase their presence in emerging markets across Africa and Southeast Asia.

Conclusion

India’s automobile manufacturing sector is at a pivotal moment, marked by rapid technological shifts, regulatory pressures, and evolving consumer preferences. Successful adaptation will require strategic investments in electric mobility, supply chain resilience, and smart manufacturing. Companies that leverage innovation, strategic partnerships, and operational efficiency will emerge as industry leaders in the next phase of automotive growth. Waltcorp is positioned to support automotive manufacturers in navigating this complex landscape through strategic consulting, operational insights, and technology integration.