How Strategic Investments and Government Support Are Driving Industry Growth

Introduction

India’s semiconductor manufacturing industry is rapidly emerging as a key player in the global electronics market. Traditionally reliant on imports for semiconductor components, India is now investing heavily in domestic production capacity to meet the surging demand for chips in automotive, consumer electronics, and industrial sectors. This shift is fueled by a combination of government incentives, foreign direct investment (FDI), and strategic partnerships with global technology firms. The following report examines the growth drivers, key industry players, government initiatives, and challenges shaping India’s semiconductor manufacturing sector.

Growth Drivers in India’s Semiconductor Industry

India’s semiconductor industry is being propelled by a confluence of strategic market forces and evolving consumer demands.

1. Increasing Demand for Semiconductors

The demand for semiconductors in India has grown exponentially due to the rise of smartphones, electric vehicles (EVs), and smart manufacturing systems. India currently imports nearly 90% of its semiconductor needs, creating a significant opportunity for local manufacturing.

- Automotive and EV Industry: Electric and autonomous vehicles require advanced chips for battery management, connectivity, and driver-assistance systems. Companies like Tata Motors and Mahindra & Mahindra are integrating AI-driven chips for enhanced vehicle performance and automation.

- Consumer Electronics: With over 1.2 billion mobile connections and a rapidly expanding middle class, India’s consumer electronics market is creating massive demand for chips used in smartphones, smart TVs, and wearable devices.

2. Global Supply Chain Realignment

Geopolitical tensions and disruptions in global supply chains have prompted companies to diversify their manufacturing bases. India’s strategic location and large labor pool make it an attractive alternative to traditional manufacturing hubs like China and Taiwan.

- China-Plus-One Strategy: Multinational companies are adopting the “China-Plus-One” strategy to reduce dependence on Chinese manufacturers by expanding operations in India.

- Resilient Supply Chains: By localizing semiconductor production, India aims to build a more resilient supply chain capable of withstanding global disruptions.

Government Initiatives and Policy Support

The Indian government has launched a series of initiatives to establish India as a global semiconductor manufacturing hub.

1. Production-Linked Incentive (PLI) Scheme

The PLI scheme provides financial incentives for setting up semiconductor fabrication plants (fabs) and assembly facilities. The government has allocated over $10 billion for semiconductor manufacturing under this initiative.

- Micron’s Investment: Micron Technology announced a $2.75 billion investment to establish a chip assembly and testing facility in Gujarat under the PLI scheme.

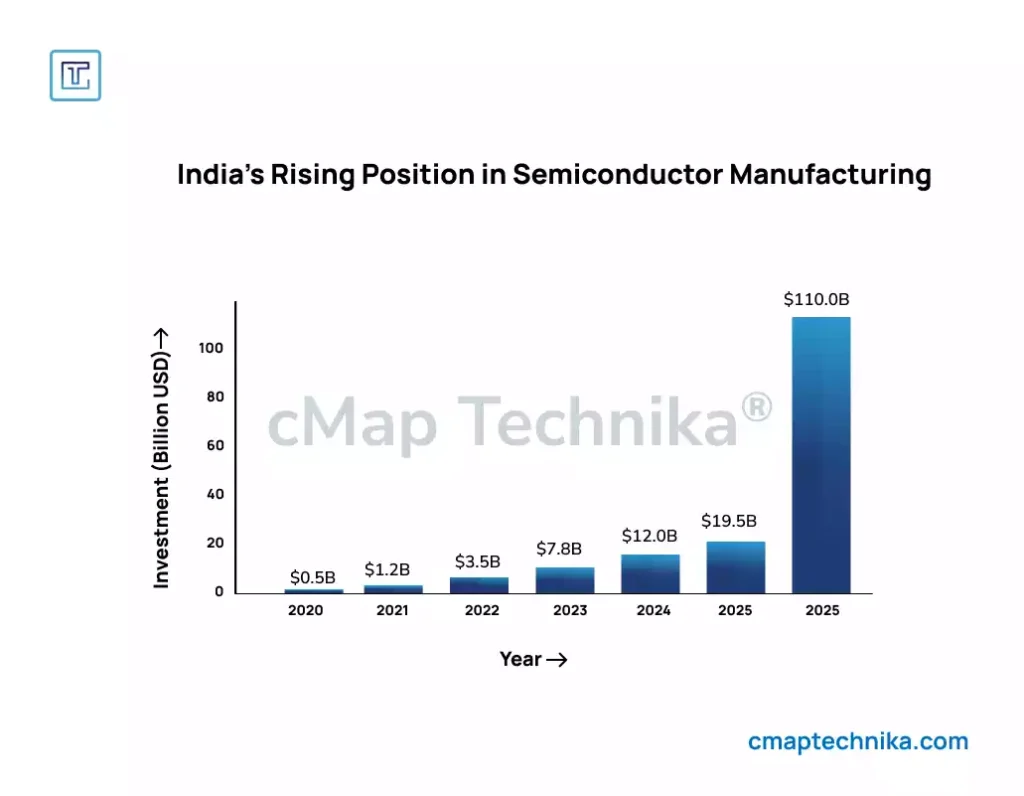

- Vedanta-Foxconn Partnership: Vedanta and Foxconn have committed $19.5 billion to establish India’s first semiconductor manufacturing plant in Gujarat, projected to create over 100,000 jobs.

2. Design-Linked Incentive (DLI) Scheme

The DLI scheme supports companies involved in chip design and intellectual property (IP) development.

- Government Funding: Over $1.2 billion in funding is allocated for semiconductor design startups.

- STMicroelectronics Collaboration: STMicroelectronics is partnering with Indian startups to develop AI-based chip designs for automotive and smart device applications.

3. Semiconductor Mission

The India Semiconductor Mission (ISM) was launched in 2021 to develop a long-term strategy for semiconductor self-sufficiency.

- Policy Framework: The ISM focuses on infrastructure development, talent acquisition, and international partnerships.

- Global Partnerships: India has signed memorandums of understanding (MOUs) with Taiwan, Japan, and the US to facilitate technology transfer and joint ventures.

Strategic Investments and Partnerships

India’s semiconductor sector is attracting significant foreign and domestic investments, signaling long-term growth potential.

1. Global Tech Giants Enter Indian Market

Leading semiconductor manufacturers and technology companies are establishing operations in India to leverage local cost advantages and skilled labor.

- Intel: Intel is building a design and R&D center in Bengaluru, expected to employ over 2,000 engineers.

- Samsung: Samsung Electronics is expanding its semiconductor packaging and testing facility in Noida, investing over $500 million.

2. Domestic Manufacturing Expansion

Indian conglomerates and technology firms are investing in building domestic manufacturing capacity.

- Tata Electronics: Tata Electronics is developing a $3 billion semiconductor fabrication plant in Tamil Nadu, focusing on chips for automotive and industrial applications.

- Reliance: Reliance Industries is exploring partnerships with global chipmakers to build a semiconductor ecosystem in Maharashtra.

Challenges in Scaling Semiconductor Manufacturing

Despite the momentum, India’s semiconductor industry faces several operational and strategic challenges.

1. High Capital Requirements

Semiconductor fabrication plants (fabs) are capital-intensive, requiring billions of dollars in upfront investment and sophisticated infrastructure.

- Fab Setup Costs: A single semiconductor fab can cost between $5 billion and $20 billion to establish, depending on the technology and scale.

- Infrastructure Gaps: Reliable power supply, water availability, and logistics infrastructure are critical to sustaining large-scale fabs.

2. Talent and Skills Gap

India lacks a deep pool of experienced semiconductor engineers and process specialists.

- Workforce Training: Building a skilled talent pipeline requires investment in specialized training programs and industry-academic collaborations.

- Technology Transfer: Effective knowledge transfer from global partners is essential to develop local expertise.

3. Technological Complexity

Advanced semiconductor manufacturing requires cutting-edge process nodes (e.g., 7nm, 5nm) and access to rare raw materials.

- Material Sourcing: Ensuring a stable supply of rare earth metals and silicon wafers is essential for maintaining production capacity.

- Process Maturity: Achieving high yield rates and low defect levels requires significant technical expertise and manufacturing discipline.

Case Study: Vedanta-Foxconn Semiconductor Plant

The Vedanta-Foxconn partnership represents a milestone in India’s semiconductor journey.

- Investment: $19.5 billion investment in Gujarat’s Dholera Special Investment Region (DSIR).

- Capacity: The plant will have an annual production capacity of 28 million chips, catering to automotive, consumer electronics, and industrial markets.

- Strategic Impact: The project is expected to reduce India’s import dependency by 20% within five years and create over 100,000 direct and indirect jobs.

- Technology Transfer: Foxconn will provide expertise in semiconductor fabrication, packaging, and testing, while Vedanta will handle operations and supply chain management.

Future Outlook

India’s semiconductor manufacturing sector is positioned for exponential growth, with the potential to emerge as a global hub for chip production. The combination of government support, strategic investments, and rising domestic demand creates a favorable environment for long-term industry expansion.

- Projected Growth: India’s semiconductor industry is expected to reach $110 billion by 2030, growing at a CAGR of 16%.

- Self-Sufficiency Goals: By 2030, India aims to produce over 70% of its semiconductor needs domestically.

- Global Integration: Strong partnerships with Taiwan, Japan, and the US will accelerate technology transfer and market access.

Conclusion

India’s semiconductor manufacturing industry is undergoing a historic transformation driven by government support, foreign investments, and technological advancements. The establishment of domestic fabs, strategic alliances with global technology leaders, and a rapidly growing domestic market create a unique opportunity for India to emerge as a major player in the global semiconductor landscape. Overcoming challenges related to infrastructure, skills, and technological complexity will be crucial to sustaining this momentum. With a clear strategic roadmap and continued government backing, India’s semiconductor sector is poised to become a cornerstone of the global electronics supply chain.